excise tax rate nc

The North Carolina excise tax on gasoline is 3750 per gallon one of the highest gas taxes in the country. North carolina excise taxes north carolinas first excise tax was levied on motor fuels in 1921 at 1 per gallon.

Russia Federal Government Revenue Oil Gas Excise Tax Crude Oil Kdamp Economic Indicators Ceic

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

. Excise Tax is a state tax computed at the rate of 100 on each 50000 or fractional part thereof of the consideration or value of the interest. The same 4 in Virginia compared to 45 in North Carolina North Carolinas local-level sales taxes vary from 25 to 3 while Virginias highest local sales tax is 1. 2016 Privilege License Tax Technical Bulletin.

Imposition of excise tax. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. North Carolina Cigarette Tax - 045 pack In North Carolina cigarettes are subject to a state excise tax of 045 per pack of 20.

Excise tax is customarily paid by the. Excise TaxRevenue Stamps. In a ranking that.

The State of North Carolina charges an excise tax on home sales of 200 per 100000 of the sales price. The North Carolina gas tax is included in the pump price at all gas statio. North Carolinas excise tax on gasoline is ranked 6 out of the 50 states.

In North Carolina wine vendors are responsible for paying a state excise tax of 100 per gallon plus Federal. North Carolinas general sales tax of 475 also applies to the purchase of wine. The NC use tax only applies to certain purchases.

How much is NC excise tax. For example a 600 transfer tax would be imposed. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

Excise Tax on Conveyances Article 8E of Chapter 105 of the North Carolina General Statutes General Information Excise Tax is a state tax computed at the rate of 100 on each. Taxes Forms Alcoholic Beverages Tax. What is the excise tax in NC.

Who is responsible for paying the state excise tax. 2016 Piped Natural Gas Tax Technical Bulletin. 105-11380 and 105-11383 ncleggov or contact the.

North Carolina Department of Revenue. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Vehicles are also subject to.

The county tax rate is 0652 per 100 of assessed The tax rate. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Cigarettes are also subject to North Carolina sales tax of.

Imposition of excise tax. 200 N Grove St Hendersonville NC 28792. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

What is the state excise tax rate. 2013 nc tax expenditure database. The tax rate is one dollar.

Houses 5 days ago 5 days ago Nc Excise Tax Real Estate 5 days ago 4 days ago When ownership in North Carolina real estate is transferred an excise tax of. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. 2016 Alcoholic Beverages Tax Tehcnical Bulletin.

When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. The North Carolina use tax is a special excise tax assessed on property purchased for use in North. Excise Tax is a state tax computed at the rate of 100 on each 50000 or fractional part thereof of the consideration or value of the interest conveyed.

Nc Real Estate Excise Tax. 2022 North Carolina state use tax. An Excise Tax return for all resident beer wholesalers and importers.

Excise Tax As A Percentage Of Taxation In Select Countries In 2016 Download Scientific Diagram

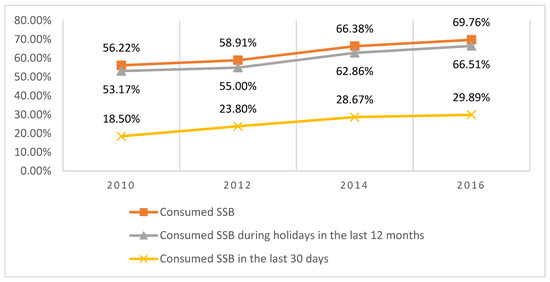

Sustainability Free Full Text Impacts Of Excise Taxation On Non Alcoholic Beverage Consumption In Vietnam Html

N C Excise Tax On Spirits Nation S Fifth Highest Carolina Journal Carolina Journal

State Cigarette Excise Tax Rates United States April 2015 Download Scientific Diagram

Car Tax By State Usa Manual Car Sales Tax Calculator

North Carolina Tax Reform North Carolina Tax Competitiveness

Wine Tax By State Easy To Read Wine Excise Tax Rates Map

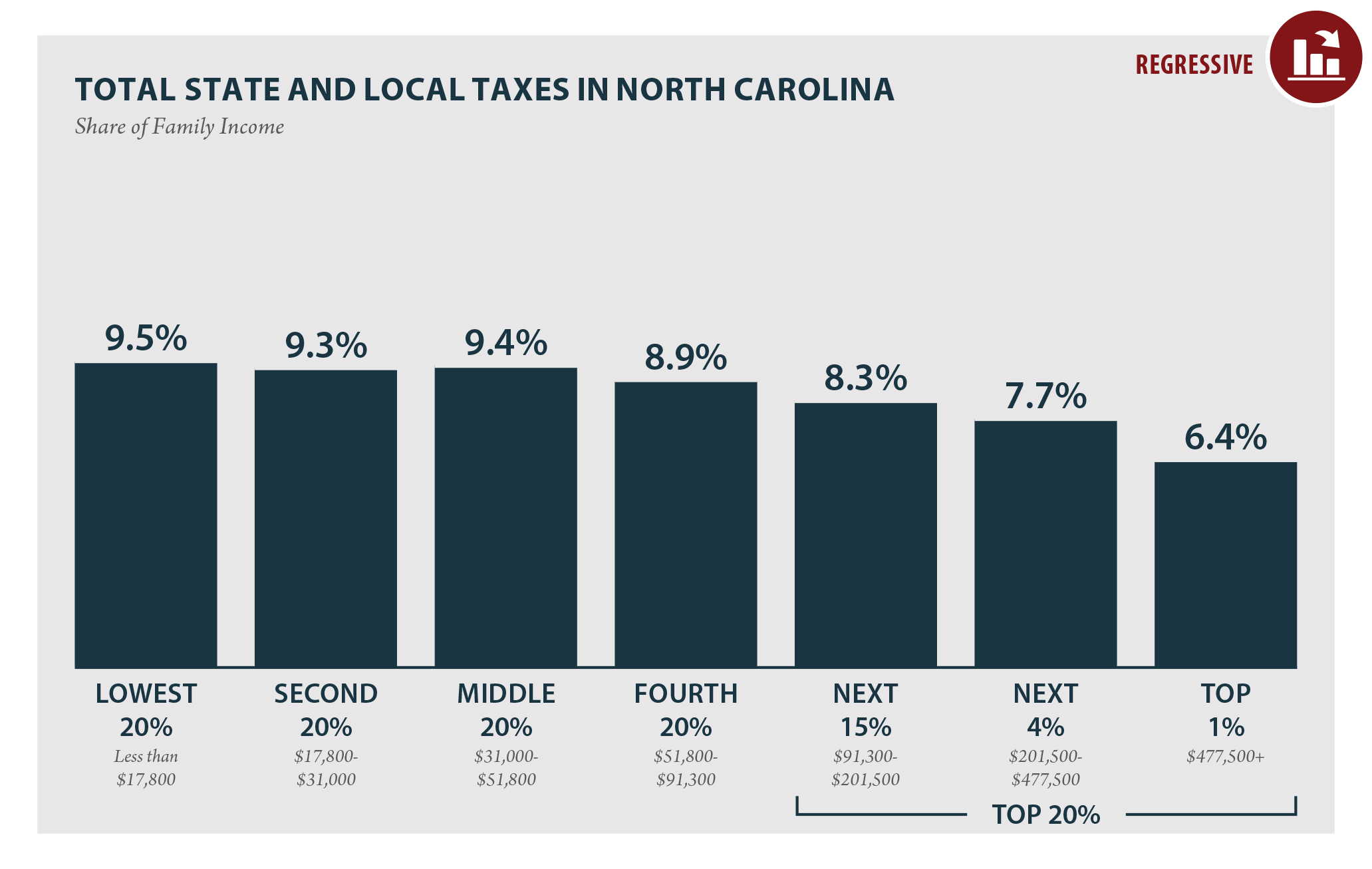

North Carolina Who Pays 6th Edition Itep

Wake County North Carolina Property Tax Rates 2020 Tax Year

North Carolina Tax Reform North Carolina Tax Competitiveness

State Motor Fuel Excise Taxes Transportation Investment Advocacy Center

States With Highest And Lowest Sales Tax Rates

Historical North Carolina Tax Policy Information Ballotpedia

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Excise Tax As A Percentage Of Taxation In Select Countries In 2016 Download Scientific Diagram

Nc Has 8th Highest Beer Tax In The Nation

Motor Fuels Taxes Diesel Technology Forum