nevada estate and inheritance tax

Does Nevada Have an Inheritance Tax or Estate Tax. The estate tax exemption was then increased in 200000.

Estate Tax Rates Forms For 2022 State By State Table

Under Nevada law there are no inheritance or estate taxes.

. It is one of the 38 states that does not apply an estate tax. So lets say that an estate is valued at 8 million which is 207 million above the limit. Estate taxes are levied on the total value of a decedents property and must.

Take an estate worth 1788 million. Youll also owe 40 of the remaining 482 million which comes to 1928 million. Estate taxes and inheritance taxes are similar but there are some important differences to note.

Inheritance tax applies to money already passed on to a persons heirs. Estate taxes are paid by the decedents estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. Make sure not to confuse the estate tax with the inheritance tax which is different.

Thats why Nevada is such a. Nevada repealed its estate tax also called a pick-up tax on Jan. The top inheritance tax rate is 16 percent no exemption threshold New Mexico.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. An estate that exceeds the Federal Estate Tax Exemption of 1206 million becomes subject to taxation. Estate taxes and inheritance taxes are similar.

No estate tax or inheritance tax. The difference between inheritance and estate tax is a matter of who is responsible for paying the tax. Thorough estate planning will help you to reduce the taxable part and protect your heirs from a fiscal burden.

Estate taxes and inheritance taxes are similar but there are some important differences to note. No estate tax or inheritance tax. The federal Estate Tax has a progressive rate that starts at 18 and can reach up to 40 significantly decreasing your inheritance.

Subtract the 1206 million exemption and you have a taxable estate of 582 million. Nevada repealed its estate tax also called a pick-up tax on Jan. Estate taxes are taken out of the deceaseds estate immediately after their passing while inheritance taxes are imposed upon the deceaseds heirs after they have received their inheritance.

This puts you in the top tax bracket and means youll have a base payment of 345800 on the first 1 million. Nevada repealed its estate tax also called a pick-up tax on Jan. To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on.

In non-pandemic times the probate assets personal property within an estate in Nevada can take anywhere from 9 months to 3 years to be distributed from the decedents estate. Once your estate goes over that value the estate tax will apply to the entire estate. Since Nevada collects so much in gaming taxes they do not impose an inheritance tax or a gift tax.

Estate tax of 306 percent to 16 percent for estates above 59 million. In 2021 the first 117mil per individual is exempt at. NV does not have state inheritance tax.

Nevada gift tax and inheritance tax planning. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. Nevada does not have an inheritance tax.

The federal government IRS may impose an inheritance tax is the value of the deceased persons entire estate is over 55 million as of. The deceased person lived in a state that collects a state inheritance tax or owned. Death tax means any tax levied by a state on account of the transfer or shifting of economic benefits in property at death or in contemplation thereof or intended to take effect in.

Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024. It is one of the 38 states that does not apply an estate tax.

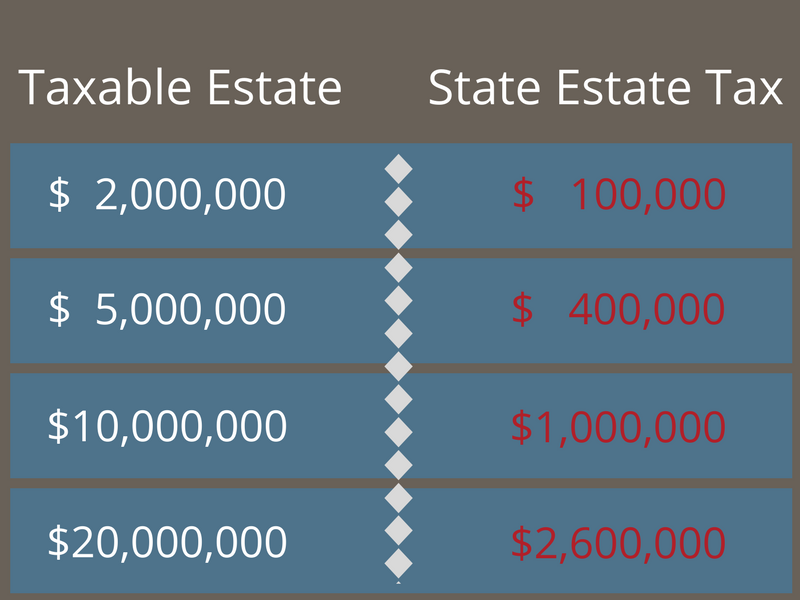

Inheritance taxes are remitted by the. The estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. No Estate Tax Laws in Nevada.

However an estate in Nevada is still subject to federal inheritance tax. Estate tax of 10 percent to 16 percent on estates above 1 million.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Recent Changes To Estate Tax Law What S New For 2019

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

The 10 Best Places To Retire In Nevada Newhomesource Best Places To Retire Nevada Places

What Would Be The Consequences Of A 100 Inheritance Tax To A Nation S Economy Quora

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Utah Estate Tax Everything You Need To Know Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

How Changing Residency Affects State Estate Tax And Income Taxes

Estates And Trust Services Tax Lawyer Inheritance Tax Divorce Attorney

State Estate And Inheritance Taxes Itep

Recent Changes To Estate Tax Law What S New For 2019